SHIELDING COMPANIES

FROM UNIONS, OSHA, AND EMPLOYEES

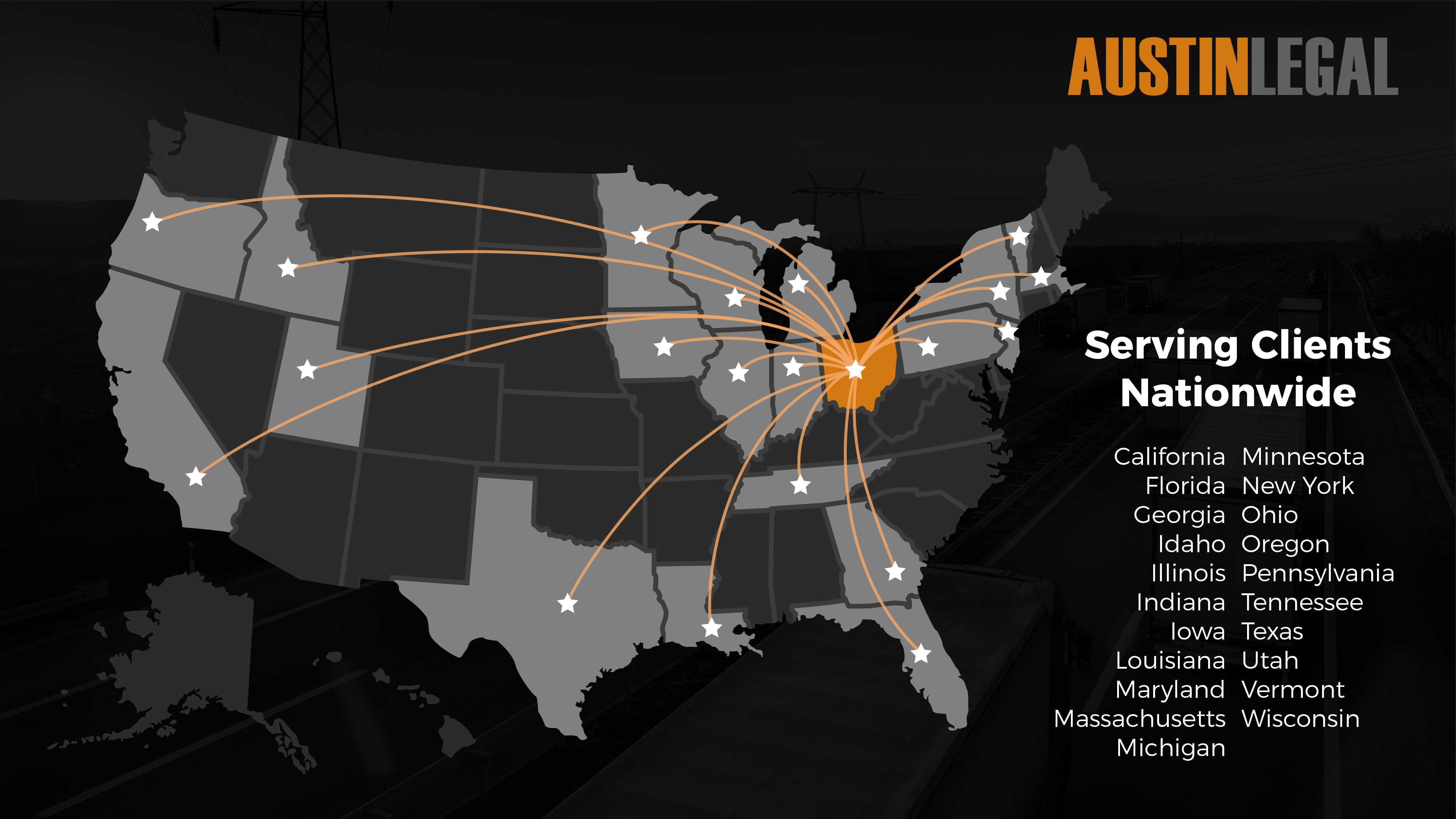

Companies trust Austin Legal as their go-to resource in managing the labor, employment, and OSHA aspects of their businesses

Practice Areas

If you have employees, you need Austin Legal

Austin Legal is Your Right Choice

In addition to shielding companies from unions, OSHA, and employees, Austin Legal keeps clients abreast of new laws and court rulings affecting their businesses and guides them in reacting to those changes. The firm routinely reviews its clients' corporate policies to ensure best practices regarding labor relations, hiring, work rules, safety, discipline, leaves of absence, wages, and terminations. Businesses and human resource departments regularly use Austin Legal as a sounding board – just to make sure they're "doing it right".

Austin Legal is the firm for all your labor law needs

Austin Legal represents employers

Matt Austin is one of a select few attorneys to be OSHA certified.

Proud Member of These Outstanding Associations: